Let’s Cut Through the Confusion

Ever walked into a payment setup for your business thinking, “I just need a payment gateway,” only to be told, “You also need a merchant account”?

Yep. Classic rabbit hole.

Especially when you’re running a high-risk business, this confusion doesn’t just waste time; it can cost you money.

So let’s settle it today: What exactly is the difference between a high-risk merchant account and a payment gateway? Do you need one, both… or something else entirely?

What Is a High-Risk Merchant ?

Imagine your business is all set to accept card payments. Great.

But wait, where do those payments actually land before they reach your bank?

That middle stop is your merchant account.

And if you’re selling in an industry flagged as “risky,” think supplements, adult content, digital goods, travel, CBD, etc., you need a high-risk merchant account.

It’s not a regular bank account. It’s more like a holding zone where customer payments rest until they’re settled. Banks use this system to protect themselves from chargebacks, fraud, and unpredictable volumes.

“A high-risk label doesn’t mean shady. It means your business model demands a closer look. And a sturdier setup.”

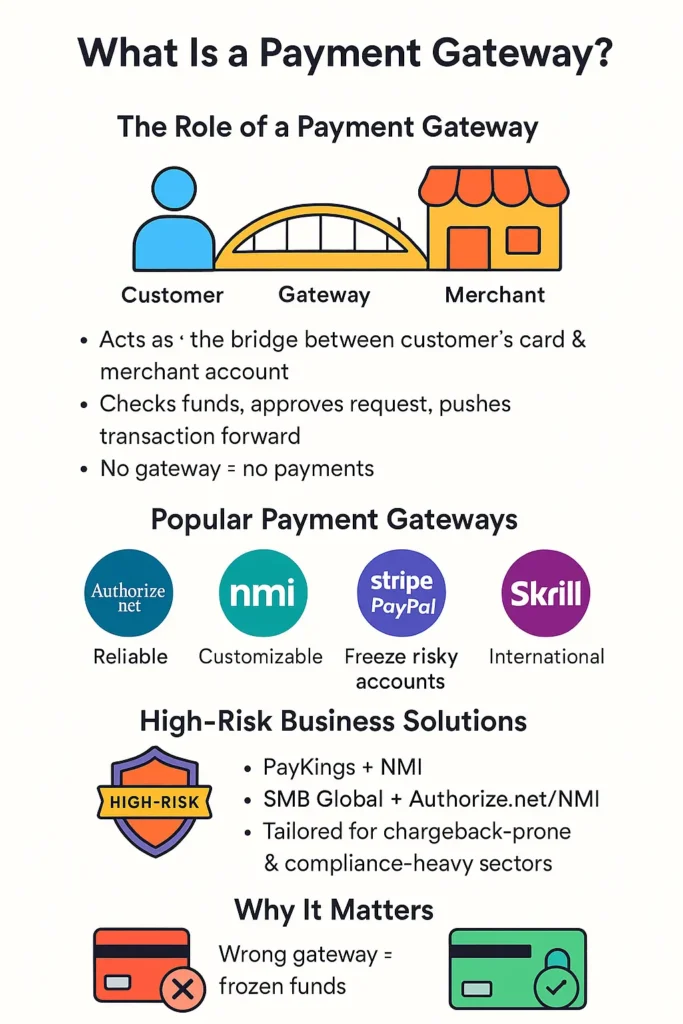

What Is a Payment Gateway, Then?

If the merchant account is the holding zone, the payment gateway is the bridge. It’s what talks to your customer’s card issuer, processes the payment request, checks if the funds are available, and then pushes the transaction forward.

No gateway? No payments.

Simple as that.

Now, you’ve probably heard of gateways like:

- Authorize.net: Old-school but reliable. Works well with many merchant account providers.

- NMI: A top pick for those needing deeply customized gateway setups.

- Stripe and PayPal: Widely used but not ideal for high-risk businesses. They’re fast to freeze or shut down accounts flagged as risky.

- PayKings: A high-risk merchant account provider that often works with compatible gateways like NMI.

- Skrill: More suitable for international or digital transactions, but not specifically tailored for high-risk industries.

- SMB Global: Not a gateway itself, but a high-risk merchant account provider that partners with secure gateways like Authorize.net or NMI.

If you’re selling in a Top 10 high-risk industry, your gateway choice matters more than you think. Because not all are built for the chargeback-prone, compliance-heavy nature of risky sectors. Another thing, interested to know more? You are in luck. Just check our “the best high-risk payment gateways” blog.

Do You Really Need Both? Yep, And Here’s Why.

Okay, let’s get right to the point.

If you’re running a high-risk business, even the smallest gap in your payment setup can cost you big. That means you do need both a payment gateway and a merchant account. No shortcuts.

Here’s how to make sense of it:

- The gateway is like the front door of your store. It’s how your customers come in, swipe their cards, and click “pay now.”

- The merchant account? That’s your cash register. It’s where the money lands first, before it heads off to your business bank account.

Now imagine this: You’ve got a great front door, but no cash register. Or you’ve got a register, but no door. Either way? You’re out of business.

And if your company isn’t properly formed or legally compliant, you might not even get to open the door in the first place. That’s why many merchants we work with start by setting up their U.S. company the right way, so everything else clicks into place from the get-go.

And for high-risk merchant accounts, this balance is even more critical. A faulty gateway, or a weak merchant account partner, could mean:

- Frozen payments

- Sudden shutdowns

- Or worse, permanent bans

So yeah. You really need both. And you need the right ones.

Let’s Clear Up More Confusion: High-Risk Merchant Account vs. Payment Gateway

I think you need a deeper understanding of the whole concept. So, here we go, the star of today:

| Feature/Function | High-Risk Merchant Account | High-Risk Payment Gateway |

| What it is | A special type of business bank account that holds your card transaction funds until they’re cleared and ready to move to your main bank account. | A tech tool that grabs, encrypts, and passes your customer’s payment info safely to the processor. It doesn’t touch the money. |

| Main Purpose | Takes in your credit/debit card payments and holds them temporarily before payout. | Just routes the card info from your site to the processor. That’s it. |

| Who provides it | Merchant service providers or acquiring banks (like PaymentCloud, Elavon, or Durango). | Gateway companies like Authorize.net, NMI, eProcessing Network, etc. |

| Handles Risk & Underwriting | Yep. These guys do deep dives: your business model, history, industry. They may slap on rolling reserves or even hold funds. | Nope. Gateways just move data. They’re not here to judge your risk profile. |

| Application & Approval | Oh yes. Be ready with documents: KYC, financials, business model, the whole shebang. | Not always. Some are plug-and-play, especially if your merchant account is already approved. |

| Chargeback Management | Most merchant accounts come with monitoring, support, and sometimes tools to fight disputes. | Gateways may offer fraud filters, but that’s about it. |

| Do They Hold Your Money? | Yes, but only temporarily; think of it like a safety checkpoint before your funds hit your bank. | Nope. They don’t even get to touch the money. |

| Can You Use It Alone? | Nah. You’ll still need a gateway or processor to actually accept payments. | Also nope. Without a merchant account, where would the money even go? |

| Example | PaymentCloud, SMB Global, Soar Payments, Elavon, First Data, Durango, Paysafe, TSYS, North American BANCard | Authorize.net, NMI, eProcessing Network, iTransact |

Heads Up: Many businesses don’t even know they’ve been flagged risky until they get that “we can’t serve you anymore” email. And it often starts with using the wrong payment gateway.

How Are High-Risk Accounts Priced Differently?

With high-risk merchant services, expect:

- Higher processing fees (usually 3.5% – 6.5%)

- Rolling reserve requirements, where part of your revenue is withheld for security

- Longer approval timelines

- Heavy scrutiny on transaction history

It’s not personal. It’s risk management.

If you’re not careful here, you’ll fall into traps we’ve seen before, like merchants who never understood the differences between high-risk and low-risk merchant accounts, and ended up using low-risk tools for high-risk models. (Yep, recipe for shutdown.)

Choosing the Right Partner

You can’t just Google and pick any gateway or provider.

You need a partner who gets your industry, understands how to reduce chargebacks, and knows how to set up rolling reserve structures that don’t squeeze your cash flow.

This is where knowing how to choose the right high-risk merchant provider makes a huge difference.

Let’s Not Pretend There Aren’t Mistakes to Avoid

- Choosing a gateway like Stripe when you’re high-risk? Red flag.

- Hiding your product model during onboarding? Bigger red flag.

- Ignoring documentation or not preparing a proper business case? You’re asking for rejection.

All classic merchant approval mistakes that can be avoided.

And Here’s Where We Come In

We’ve helped dozens of businesses with:

- High-risk merchant account approval

- Payment gateway integration (that actually works with high-risk industries)

- Clear, transparent onboarding with proper risk documentation

- And no hidden traps

If you’re lost in this maze of approvals, account freezes, and rejections, don’t wing it. Let us help set it up right from day one.

Explore our high-risk merchant services and let’s figure it out together.

Closing Thoughts

So, merchant account or gateway?

If you’re high-risk, it’s not an either-or game. You need both, and you need them built for your business, not just thrown together.

One holds the money.

One moves the money.

And both protect your business when the stakes are high.

“You don’t need a low-risk setup that breaks under pressure. You need a high-risk solution that bends, adapts, and holds steady.”

FAQ

- Can I use PayPal as a high-risk merchant?

Answer: You can, but it’s quite risky.

PayPal is known to flag and freeze high-risk accounts without warning. Better to go with industry-specific solutions.

- Is Stripe a payment gateway or a merchant account?

Answer: Both. But only for low-risk businesses. Stripe bundles gateway + merchant account in one. But for high-risk, you’re safer separating them with a dedicated provider.

- Why was my account shut down after months of working fine?

Answer: You likely got flagged retroactively. If your product model changed or your chargebacks spiked, your “low-risk” provider might’ve pulled the plug. Happens a lot.

- What’s a rolling reserve, and why does it exist?

Answer: It’s a % of your earnings held temporarily to cover potential chargebacks. Essential in high-risk merchant accounts. Learn more about this in our post on rolling reserve basics.

- How can I increase my chances of approval as a high-risk merchant?

Answer: Clean documentation, a real business website, realistic projections, and transparency during onboarding. All explained in our merchant approval tips.

- Do I have to tell my provider I’m in a high-risk industry?

Answer: Yes. 100% yes. Trying to fly under the radar might get you approved faster, but it also guarantees one thing: you’ll be shut down just as fast. Be upfront. A proper high-risk merchant provider already knows how to work with your industry. Let them.

- Why are high-risk accounts always more expensive?

Answer: Because banks and processors are playing defense. More chargebacks, more refund requests, more fraud potential. It means more risk on their side. So they charge more to offset that. Think of it like high-risk insurance; it comes at a cost, but it’s what keeps you protected.

- Can’t I just use my personal Stripe account to test sales first?

Answer: You can, but it’s a risky game. If they catch you selling anything they label as “restricted,” they won’t just shut you down. They’ll freeze your funds. And in some cases, hold it for months. Don’t test the waters with your actual money.

- Is it okay to launch without a merchant account and only accept PayPal or crypto?

Answer: Technically, yes. But you’ll lose customers. And credibility. A real merchant account signals that your business is legit. If you’re serious about scaling, you need something stable and widely accepted.

- How long does it usually take to get approved for a high-risk merchant account?

Answer: If your documents are solid and you’re working with someone who actually knows the ropes, it typically takes about 3 to 7 business days. But if your business falls into one of those “watch closely” categories or you’ve had a few bumps in the past, it could take a bit more time.

Here’s the thing: though most delays happen because folks rush the onboarding process. Don’t. Go slow, double-check everything. It’ll save you way more time in the long run.

- What happens if I get too many chargebacks?

Answer: When chargebacks start creeping up, things can get messy fast. Your payment processor might slap on stricter rolling reserves, bump up your fees, or, worst-case, they might just close your account entirely. That’s why we always say: don’t wait for trouble. Set up smart systems early to keep those chargebacks in check from day one.

- What if I switch from low-risk to high-risk later on?

Answer: That’s a problem. Providers don’t like surprise changes. If you switch industries or start selling riskier products, tell your provider immediately. They’ll either update your profile or help you migrate to a more suitable account. Silence isn’t golden here.