So, Who’s Really Got Your Back When the Risk is High?

Let me guess… you’ve been through it. Banks side-eyeing your niche, PayPal freezing your funds, Stripe ghosting you without notice. Suddenly, you realize: this isn’t just about taking payments. It’s about survival.

High-risk businesses don’t get the same welcome mat as low-risk ones. You’ve probably read a hundred times that “you need a specialized solution,” but no one tells you what that actually means, or which provider won’t leave you in limbo when chargebacks hit the fan.

Let’s break that down. Like real people. You and me. No corporate gloss. No fairy dust. Just what actually works out here.

First, What Makes a Business “High-Risk”?

I won’t bore you with unnecessary legal terminology. Here’s the real deal:

If your business is prone to refunds, faces legal scrutiny, works with subscriptions, has large ticket sizes, or deals globally (especially in industries like nutraceuticals, adult services, CBD, dropshipping, or tech support)—you’re on the “we’re watching you” list.

Some call it the Top 10 high-risk industries list. And trust me, if you’re on it, everything from rolling reserve holds to random merchant account reviews becomes your normal.

Why Picking the Right Gateway Matters (A Lot)

You see, the wrong payment processor can:

- Cancel your account overnight

- Freeze your rolling reserve with zero context

- Flag every refund like it’s fraud

- Or worse, reject you before you even start

That’s why this blog isn’t about every gateway. It’s about the ones that are built for high-risk merchant accounts and actually give a damn.

Best Payment Gateways for High-Risk Businesses in 2025

If you’re still wondering which gateways won’t flinch at your industry label or freeze your funds without warning, this list is for you:

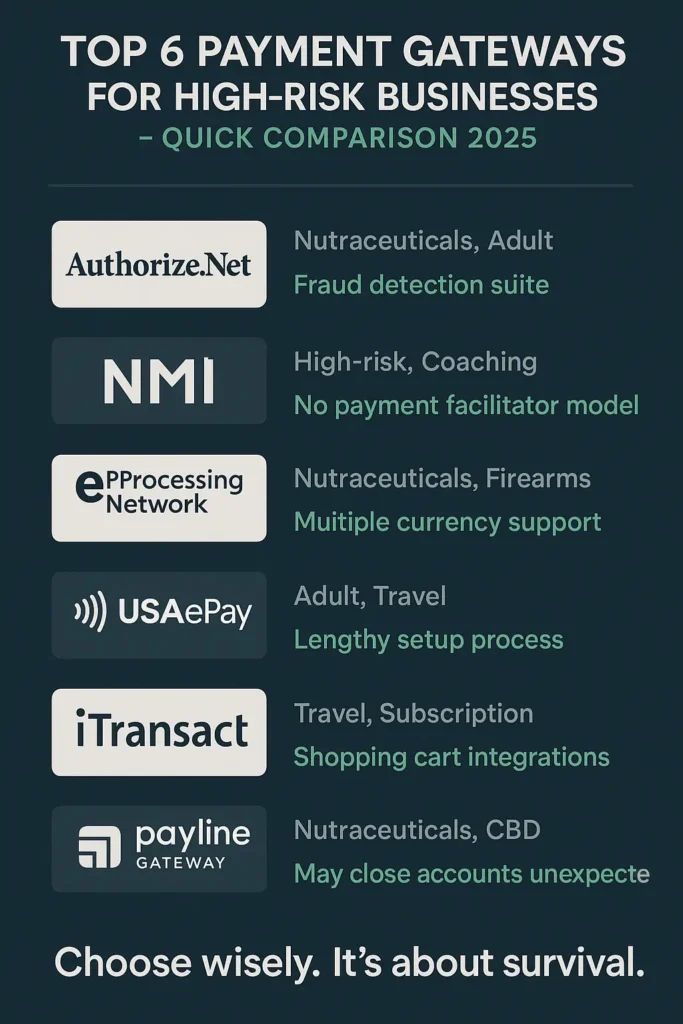

- Authorize.Net

Used by both small and enterprise businesses, Authorize.Net isn’t flashy, but it’s quite solid, if you may ask. It works well for high risk if you’re pairing it with a strong back-end processor (like eMerchantBroker or PaymentCloud). Their fraud detection suite gives you good control, which helps in reducing chargebacks before they spiral.

Ideal for: Travel, eCommerce, coaching, nutraceuticals

Note: Needs to be paired with a compatible high-risk merchant provider

- NMI (Network Merchants Inc.)

NMI is more like the behind-the-scenes wizard. It’s not a processor itself, but a gateway integrator that works beautifully with high-risk merchant accounts. If your provider supports NMI, you get multi-bank routing, fraud filters, and control over recurring billing.

Ideal for: Subscription-based businesses, adult, B2B

Note: Not a merchant account itself; must be integrated with a provider like Durango or Soar Payments.

Pro Tip: Most high-risk payment solutions require your business to be properly structured in the U.S. or the U.K. first. If you’re not yet formed, we can help you set up a compliant company before moving to the gateway setup.

- eProcessing Network (ePN)

If your business relies heavily on mobile payments, ePN could be your friend. It provides a secure gateway with mobile, online, and even retail POS support. Their features aren’t bloated but do cover what high-risk folks actually need: tokenization, recurring billing, and fraud filters.

Ideal for: Multi-channel high-risk businesses (POS + online), ticket sales, dropshipping, CBD, etc.

Note: Compatible with most high-risk merchant accounts

- USAePay

One of the OGs of gateway technology, USAePay comes with reliability baked in. It’s cloud-based and secure, but it feels a little “old-school” in interface. That said, it supports a wide variety of integrations for high-risk businesses and plays nice with mobile apps too.

Ideal for: Firearms, adult products, nutraceuticals

Note: Best used with high-risk processors like SMB Global

- iTransact

This one’s more niche but earns its keep. iTransact works particularly well with industries considered “very high risk.” You get powerful backend reporting, fraud tools, and hands-on onboarding if your volume justifies it.

Ideal for: MLM, telemedicine, financial coaching

Note: Pricing can be on the premium side; works best when pre-negotiated via merchant providers like EMB.

- Payline Gateway

It’s modern, API-friendly, and more flexible than some legacy players. While Payline isn’t only for high-risk, it can be configured for such industries depending on the merchant account backing it. Solid for scaling businesses that expect to grow.

Ideal for: Health and wellness products, online consulting, continuity billing

Note: Only effective when paired with a high-risk merchant account that supports their backend

Picking the Right One Isn’t Just About Rates

You could be chasing the lowest rate and still get buried in rolling reserves, poor support, and sudden shutdowns. Your priority should be sustainability, not just savings.

Just like in how to choose the right high-risk merchant provider, this isn’t a popularity contest. It’s a compatibility test.

Bonus Tips to Increase Approval Chances & Stay Compliant:

- Be transparent: Don’t hide chargebacks or past terminations.

- Organize your paperwork: Clean financials = higher trust.

- Know your industry label: Learn where you fall in the high-risk vs low-risk merchant accounts spectrum.

- Reduce refund triggers: Consider tools to reduce chargebacks.

- Avoid rookie errors: Seriously, stay careful and avoid mistakes when managing a high-risk merchant account.

Do You Actually Need a Payment Gateway and a Merchant Account?

Let’s be real. Most people confuse the two. Heck, some providers don’t even explain it clearly.

So here it is:

- A payment gateway is a technology that securely passes customer card information to processors.

- A merchant account is the bank-style holding place where those funds go before landing in your actual business account.

Still unclear? Let’s take a brief look at the High-Risk Merchant Account vs. Payment Gateway comparison:

| Feature/Function | High-Risk Merchant Account | High-Risk Payment Gateway |

| What it is | A type of business bank account that holds funds from card transactions until they’re settled | A tech tool that captures, encrypts, and forwards customer payment info securely |

| Main Purpose | Receives and processes credit/debit card payments before deposit | Facilitates the secure transmission of card/payment details |

| Can Be Used Standalone? | Nope, you’ll need a payment gateway or processor to actually accept payments online. | No, you still need a merchant account to actually receive the money |

| Example Providers | PaymentCloud, SMB Global, Soar Payments, Elavon, First Data, Paysafe, Durango Merchant Services, TSYS, North American BANCARD | Authorize.net, NMI, eProcessing Network, iTransact |

To learn more, check out our blog “High-Risk Merchant Account vs. Payment Gateway.”

Now here’s the thing: high-risk businesses usually need both, but not every provider offers both under one roof. That’s why partnering with someone experienced in high-risk merchant services (yeah, like us—more on that in a second) is a game-changer. They bundle it all. They read between the lines. They prep your profile so you don’t get flagged before you even begin.

And trust me, when it comes to merchant account approval for high-risk businesses, the experience can save you months of waiting and thousands in losses.

The Final Word: It’s Not Just Tech. It’s Trust.

At the end of the day, your payment gateway isn’t just some tool in the background. It’s your bridge to your customer and your revenue lifeline. In high-risk businesses, trust is earned, not given. And your gateway partner needs to understand that without judgment.

So, don’t just “sign up.” Partner wisely.

“Trust is built in drops and lost in buckets.” — Kevin Plank

FAQ

- Is it hard to get a payment gateway for a high-risk business?

Let’s not sugarcoat it; it can be a bit of a hassle. But it’s not impossible. The key is applying through the right channel with clean documents and a business model that makes sense. We help with that.

- Can I just use Stripe or PayPal instead?

You can, but… should you? These platforms treat high-risk businesses like time bombs. The moment a chargeback pops up, they’re quick to freeze or shut you down. Specialized providers are your safer bet.

- What should I look for in a high-risk payment gateway?

Three things:

- Support for rolling reserves

- Chargeback & fraud tools

- Willingness to work with your merchant account provider

Bonus: if the provider doesn’t treat you like a liability.

- Is Authorize.Net or NMI better for me?

Both are strong. Authorize.Net is best for reliability, while NMI offers more flexibility and multi-processor support. Your best choice depends on your setup, and we help clients decide that based on their exact business type.

- What’s the difference between a gateway and a provider?

A gateway (like Authorize.Net or NMI) helps you process payments securely. But it’s your merchant account provider who sets your terms, fees, and reserve policies, and who fights for your approvals. You need both, but the provider is your backbone.

- Can you help me get started with a gateway and merchant account?

Yep. That’s exactly our thing. Now, whether you’re just getting started or already drowning in rejections, we’re right here to walk you through it.