Client Overview

Client: Mr. Bhatsal

Location: Gujarat, India

Service: USA Check Cashing (Mercury Bank – Business Check)

Check Amount: $22,000+

When trust meets patience, even the hardest problems turn into success.

This is the story of Mr. Bhatsal, an entrepreneur from Gujarat, India, who faced a major financial block and how, together, we solved it step by step.

Background

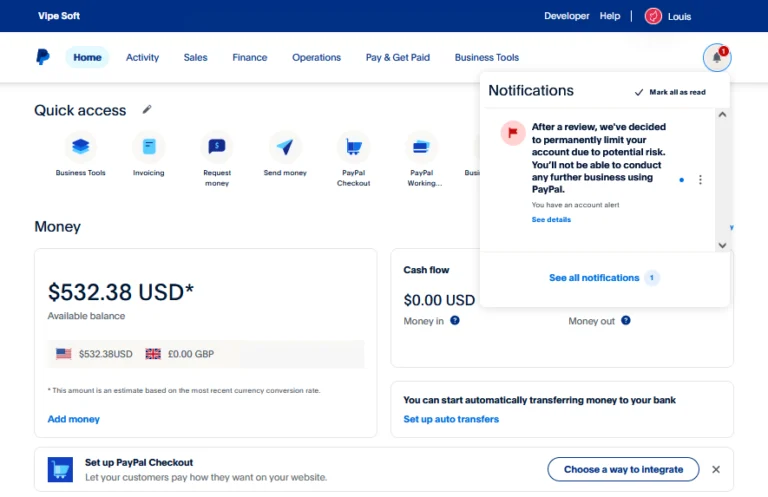

Mr. Bhatsal, an entrepreneur from Gujarat, India, owned a U.S.-registered LLC with a business account at Mercury Bank. One day, he discovered his Mercury account had been suddenly closed.

As per Mercury’s policy, when a business account is closed, the remaining funds are released as a refund check. But that check can only be cashed in person in the United States, this is where U.S. account closer check cashing becomes complicated for non-residents.

According to banking rules, only the company owner physically present in the U.S., or a representative holding at least 25% company ownership, is allowed to withdraw those funds.

As a non-resident, Mr. Bhatsal is living in India; this created a serious problem. His $22,000 remained locked for months, and no local or online banking solution in India could process it.

He needed a trusted solution to handle it professionally.

The Challenges

The biggest challenge was not just about distance; it was about compliance, legal status, and trust.

After the account closure, Mr. Bhatsal’s LLC had already become delinquent. That means it hadn’t been renewed on time, and no tax filings were made. In this condition, the company was on the verge of being dissolved.

Because the company wasn’t in good standing, its registered agent service had also expired and turned inactive. That made it impossible to receive any official letters or reissued checks at a valid U.S. address.

He needed a secure, legal, and reliable way to recover his funds without violating any banking compliance.

This wasn’t just about cashing a U.S. check; it was about trust, process, and precision. Cashing a high-value business check from outside the U.S. is not only sensitive but also risky.

Every step required legal care and patience; one mistake could mean losing the entire amount.

Our Approach when We Cash the U.S. Bank Check

When Mr. Bhatsal first contacted me through WhatsApp, his initial query was about U.S. company formation. But during the discussion, he explained his check issue in detail.

After reviewing his case, I assured him that I could help, but it would take proper documentation and patience.

I began by reviving his LLC and assigning a new registered agent, Business Globalize, so his documents and reissued check could reach the right address.

However, the first check was mistakenly issued in his personal name, not under the LLC. That meant it couldn’t be processed under the business check cashing channel. We immediately notified him, guided him through the reissue request again, and maintained all communication with the bank on his behalf.

Shortly after, we arranged for Mercury Bank to reissue the refund check under the LLC’s business name so it could be processed through our verified business check-cashing system.

It took nearly three months, several follow-ups, and continuous updates. But Mr. Bhatsal remained calm, supportive, and responsive throughout. His patience and trust made all the difference.

The Outcome

Once the correct check arrived, I processed and cashed it within seven days.

Mr. Bhatsal received his $22,000+ funds safely, without traveling to the U.S. or depending on any third party.

This success was built on transparency, consistent updates, and complete legal compliance from start to finish. It was the mutual trust and smooth coordination between both sides.

Key Takeaway

Many people think distance makes business harder, but this story proves otherwise. This case shows that even when banking restrictions seem absolute, the right process and partnership can make a difference.

With the right guidance, transparent communication, and mutual trust, even a complex problem can be solved efficiently.

Lesson

“No process is too complex when both sides work with patience and honesty.”

This case reminds me that real success doesn’t come from shortcuts; it comes from staying consistent, clear, and trustworthy till the end.